The Economic Impact of Vacation Rentals in Aruba

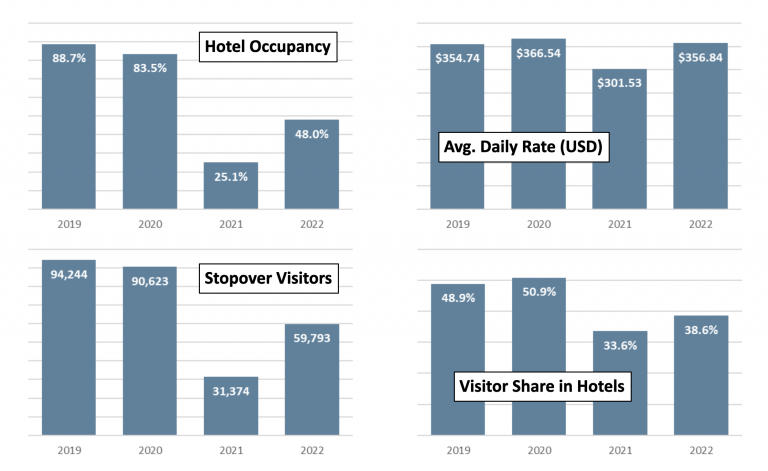

Overall Baseline Tourism Outlook

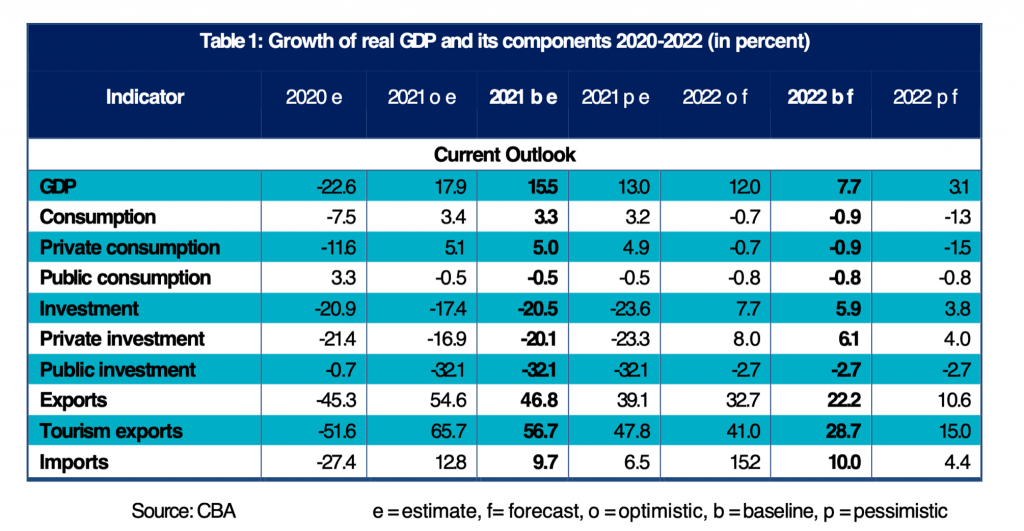

- The tourism sector is anticipated to continue its recovery in 2022, topped off by a pick-up in investment.

- The number of stay-over visitors in the baseline scenario is expected to amount to 95.0 percent of the 2019-level. In addition, tourism credits per night are assumed to have normalized at levels that are slightly higher than the pre-pandemic levels of 2019.

- Consequently, tourism service exports in nominal terms are forecasted to grow by 33.8 percent compared to 2021. With this growth, the level of tourism credits in 2022 surpasses the pre-pandemic level of tourism credits, standing at 103.4 percent of the 2019-level.

- The rebound in the tourism sector is expected to lead to a lower level of unemployment compared to 2021 (7.7 percent). The latter has a positive effect on private consumption. This is complemented by a slight growth in public consumption, as government consumption and investment are expected to remain relatively stable compared to 2021, due to spending cutbacks as well as liquidity constraints.

- Even so, the projected relatively higher level of inflation in 2022 leads to a dampening in both private and public consumption in real terms.

Overall Economic Forecasts

- The tourism sector is anticipated to continue its recovery in 2022, topped off by a pick-up in investment.

- The number of stay-over visitors in the baseline scenario is expected to amount to 95.0 percent of the 2019-level. In addition, tourism credits per night are assumed to have normalized at levels that are slightly higher than the pre-pandemic levels of 2019.

- Consequently, tourism service exports in nominal terms are forecasted to grow by 33.8 percent compared to 2021. With this growth, the level of tourism credits in 2022 surpasses the pre-pandemic level of tourism credits, standing at 103.4 percent of the 2019-level.

- The rebound in the tourism sector is expected to lead to a lower level of unemployment compared to 2021 (7.7 percent). The latter has a positive effect on private consumption. This is complemented by a slight growth in public consumption, as government consumption and investment are expected to remain relatively stable compared to 2021, due to spending cutbacks as well as liquidity constraints.

- Even so, the projected relatively higher level of inflation in 2022 leads to a dampening in both private and public consumption in real terms.

Central Bank sees strong rebound from pandemic continuing – driven largely by tourism and private investment.

Inflation and cessation of government subsidy programs undermine consumption.

Methodology/Approach

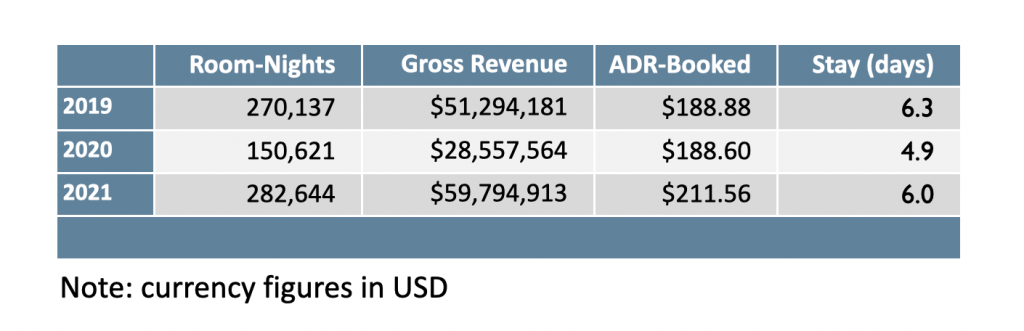

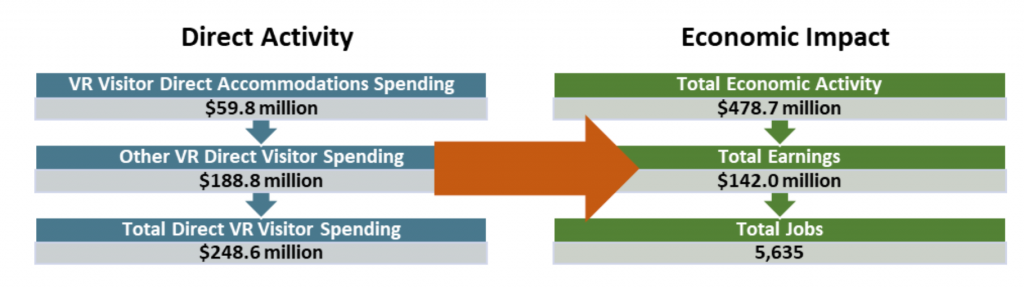

- Gather data on direct Vacation Rental (VR) accommodations spending (and other information) – AllTheRooms is the vendor/source.

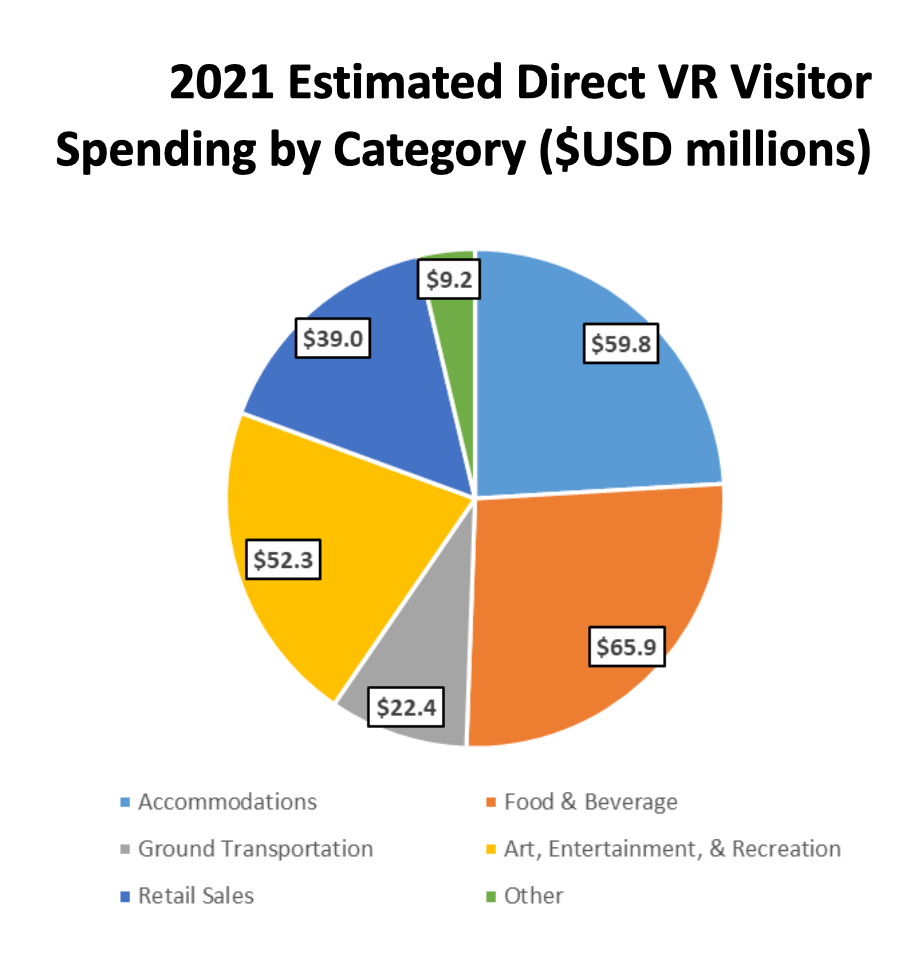

- Use the direct VR accommodations spending as the lever to estimate additional local direct visitor spending, e.g, “for every dollar of VR accommodations spending, an additional $2.15 is spent locally on food & beverage, entertainment, retail, arts & culture, etc.” Aruba Tourism Authority is the source for historical tourism spending data (2019).

- Use the direct spending outlined above as inputs into an input-output model that allows estimation of the “ripple effects.” (see Albert E. Steenge & Annemieke M. Van De Steeg (2010) TOURISM MULTIPLIERS FOR A SMALL CARIBBEAN ISLAND STATE; THE CASE OF ARUBA, Economic Systems Research, 22:4. www.tandfonline.com/doi/abs/10.1080/09535314.2010.526926).

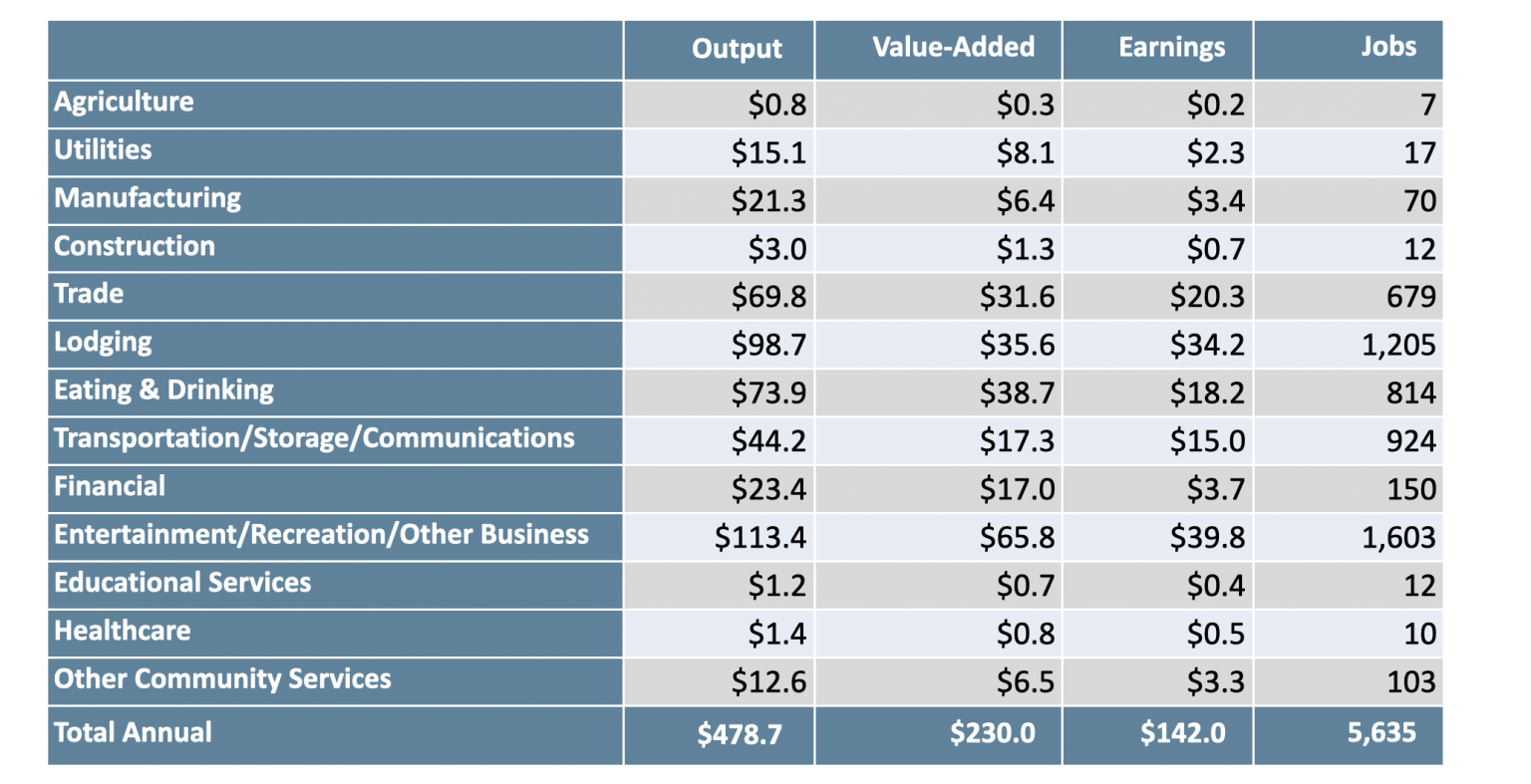

- Results measured in top-line revenue, value-added, earnings by proprietors and workers, and jobs

Summary/Conclusions

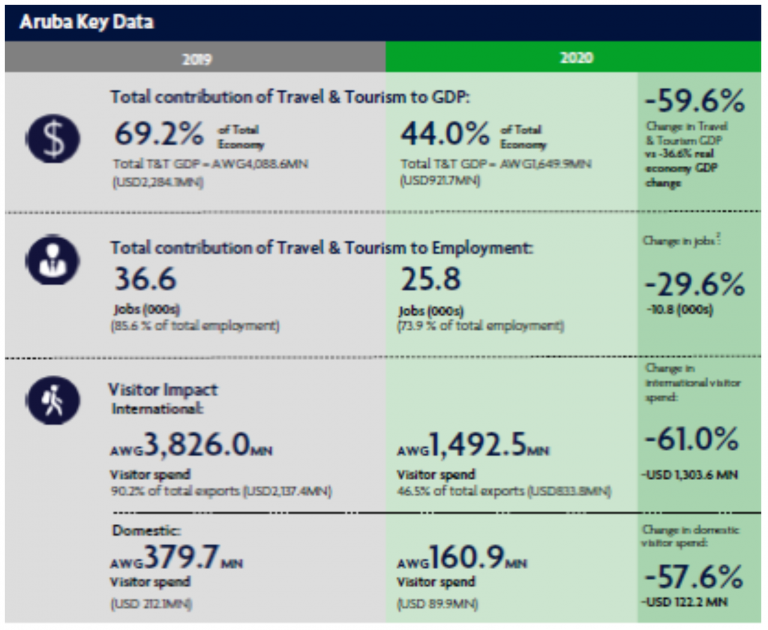

- Tourism is widely considered to the be foundation of Aruba’s economy, accounting prior to the pandemic for almost 70 percent of GDP and over 85 percent of all jobs.

- The pandemic has focused the need for a diversity of lodging options; leisure travelers have assumed an increasing importance, and many seek to be in their own facility and/or able to stay with other members of their group.

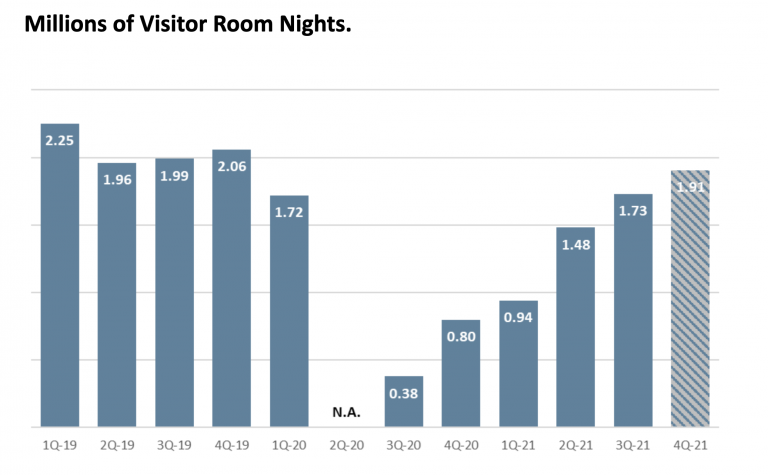

- In light of these trends, it is not surprising that VR travel reached an all-time high in Aruba during 2021, recovering more quickly than tourism overall.

- The impact of $248.6m USD in direct VR visitor spending translates into $478.7m USD in total economic activity and just over 5,600 jobs.

- Post-pandemic, it is likely that the economic impact of VR in Aruba approaches 20 percent of total tourism – a figure that could well grow over time.

Study by TXP – For more information, go to www.txp.com